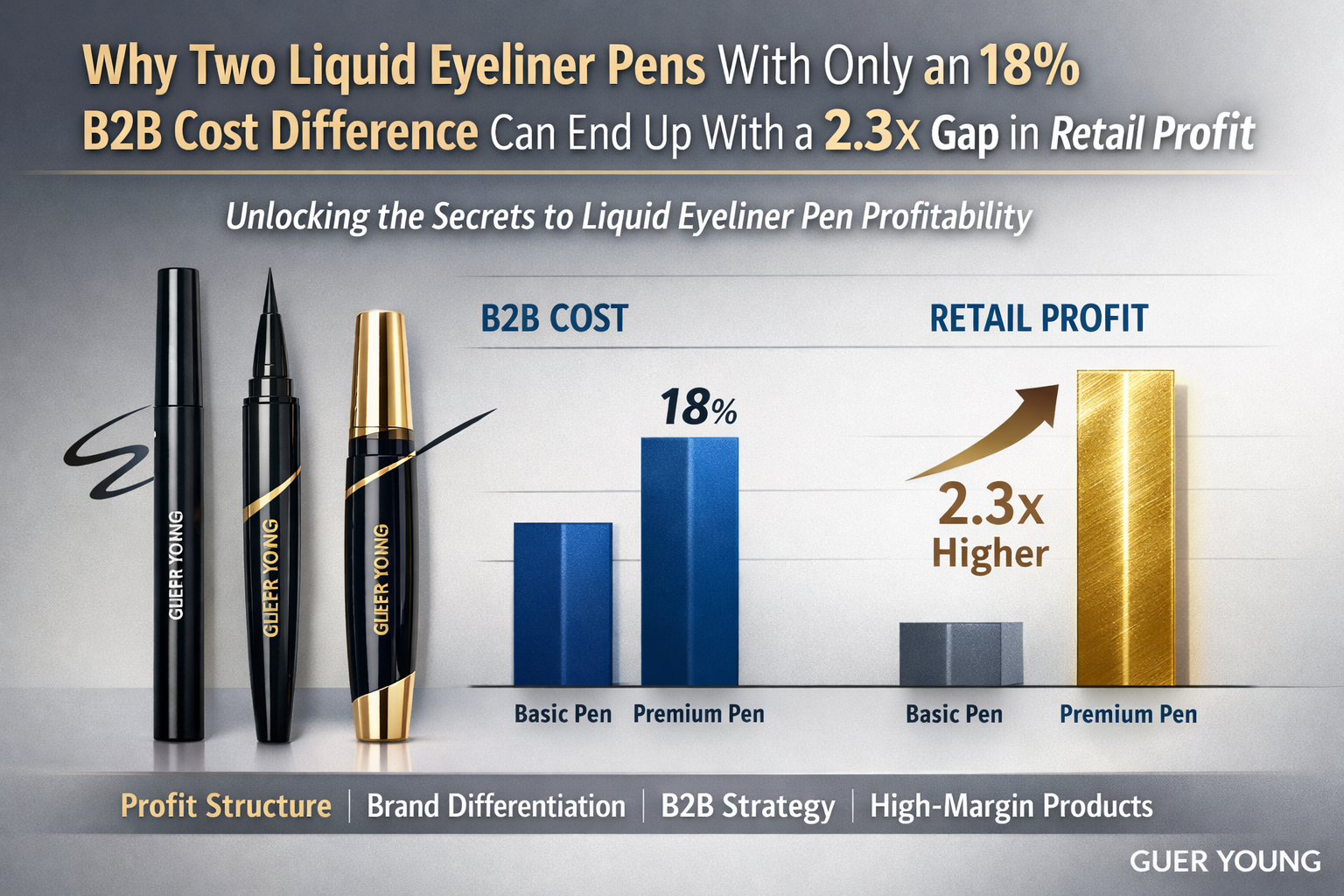

Why Can Two Liquid Eyeliner Pens With Only an 18% Difference in B2B Cost End Up With a 2.3× Gap in Retail Profit

Introduction The “Price Hammer” Illusion Behind Liquid Eyeliner Pen Margins

When talking with cross-border beauty sellers and emerging cosmetic importers, I often hear this comment:

“I already secured a very competitive B2B price for this liquid eyeliner pen, but the profit is still disappointing.”

What usually surprises people is the real data behind it.

Two sellers source almost the same liquid eyeliner pen, with only around an 18% difference in B2B cost, yet one struggles with thin margins while the other achieves up to 2.3× higher profitability at retail.

This is not a sourcing problem.

It is a profit illusion.

In a category like liquid eyeliner pens—often seen as highly commoditized—profit is not determined by factory price alone, but by a system made up of supply chain structure, brand positioning, market strategy, and user perception.

In this article, I’ll break down why identical liquid eyeliner pens can produce completely different business outcomes, and share practical, executable strategies for beauty entrepreneurs who are building or scaling brands.

Four Liquid Eyeliner Pen Cases | Same SKU, Different Business Outcomes

Case 1: Basic OEM Liquid Eyeliner Pen (Price-Driven Model)

B2B cost: $0.55

Channel: Marketplace listing, price competition

Retail price: $3.99

Logic: Volume-focused, low brand equity, weak repurchase

In this model, margins are quickly eaten up by platform commissions, advertising costs, and promotions.

The issue isn’t the product—it’s the lack of differentiation.

Case 2: Private Label Upgraded Liquid Eyeliner Pen (Formula + Packaging)

B2B cost: $0.65 (+18%)

Upgrades: More stable ink flow, anti-smudge testing, customized tip and packaging

Retail price: $9.9–12.9

Here, the seller doesn’t win by lowering cost, but by rebuilding perceived value.

A small cost increase opens a much wider pricing range.

Case 3: Market-Specific Liquid Eyeliner Pen (Middle East / Southeast Asia)

B2B cost: $0.68

Customization: Higher waterproof level, stronger pigmentation, localized compliance labels

Retail price: $14–18

Profit comes from understanding regional demand, not from reinventing the product itself.

Case 4: Brand-Driven DTC Liquid Eyeliner Pen

B2B cost: $0.70+

Investment focus: Brand story, visual system, education, community

Retail price: $19–25

The industry consensus is clear:

Consumers pay for trust, not for the cost structure of a liquid eyeliner pen.

15 Actionable Ways to Build Differentiated Profitability (4 Dimensions)

A. Supply Chain & Cost Control (4)

Compare consistency and defect rates—not just unit price

Optimize MOQ with a “core liquid eyeliner pen + extension SKUs” structure

Modularize formula, tip, and packaging to reduce customization cost

Design regulatory compliance early to avoid hidden margin loss

B. Brand Building (4)

Decide whether you sell performance—or identity

Tell an ingredient story, not just an ingredient list

Packaging is your first and cheapest advertising channel

Visual consistency significantly reduces consumer decision friction

C. Market & Channel Strategy (4)

Different markets require completely different pricing logic

Marketplace selling and brand selling follow different algorithms

B2B distributors prioritize long-term margin protection

Limited or exclusive SKUs increase channel confidence

D. User Experience (3)

Application smoothness and wear time drive repurchase—not first price

Solve real pain points: smudging, fading, sensitivity

Upgrade liquid eyeliner pens from “consumables” to “daily essentials”

Conclusion Is the Liquid Eyeliner Pen Category Still Worth Doing?

Liquid eyeliner pens are not “overcrowded”—low-level competition is.

In the next three years, profitable players will be those who:

Understand supply chains but don’t sell factory prices

Read markets instead of copying bestsellers

Treat a single SKU as a long-term brand asset

The same liquid eyeliner pen can lead to very different results.

The difference is not luck—it’s system design.

If you are:

Building or restructuring a beauty brand

Rethinking the profit model of liquid eyeliner pens

Or optimizing cross-border product strategy

Feel free to comment or message me.

—

GUER YOUNG

Finished Makeup Independent Website Supplier / B2B Seller

#liquideyelinerpen#finishedmakeup#makeupoem#makeupodm#beautysupplychain#crossborderecommerce#beautybusiness#beautyimporter#emergingbrands#privatelabelmakeup#beautyb2b#cosmeticswholesale#branddiffere

ntiation#profitstructure#highmarginproducts#beautystartup#dtcbrand#productselection#skustrategy#pricingstrategy#brandpremium#channelstrategy#userexperience#repurchaserate#inventoryturnover#compliancecost#internatio

naltrade#makeupexport#cosmeticsimport#beautyseller#supplychainmanagement#marketpositioning#middleeastbeauty#southeastasiabeauty#europeanmarket#cosmeticsregulation#businesslogic#profitmodel

winnie.zhong@gueryoung.com

We have 10 years of experience, focusing on the development and sales of high quality eyelash growth serum, mascara, eyebrow gel, eyebrow color and other products. We also offer custom services, from tube

design to cosmetic fillings and packaging

Room 1, C3 Factory Building, No.8803 Zhuhai Avenue, Lianwan Industrial Zone, Pingsha Town, Gaolan Port Economic Zone, Zhuhai, Guangdong,China

QUICK LINKS

andy.li@gueryoung.com

lynn.zhou@gueryoung.com

niki.xu@gueryoung.com